REDLINING

HISTORY EFFECTS ON OUR COMMUNITY

The Three R’s (Relief, Recovery and Reform) were created under the New Deal to give relief for the poor, recovery of the economy and reform of the nation’s financial system to safeguard against future depression.

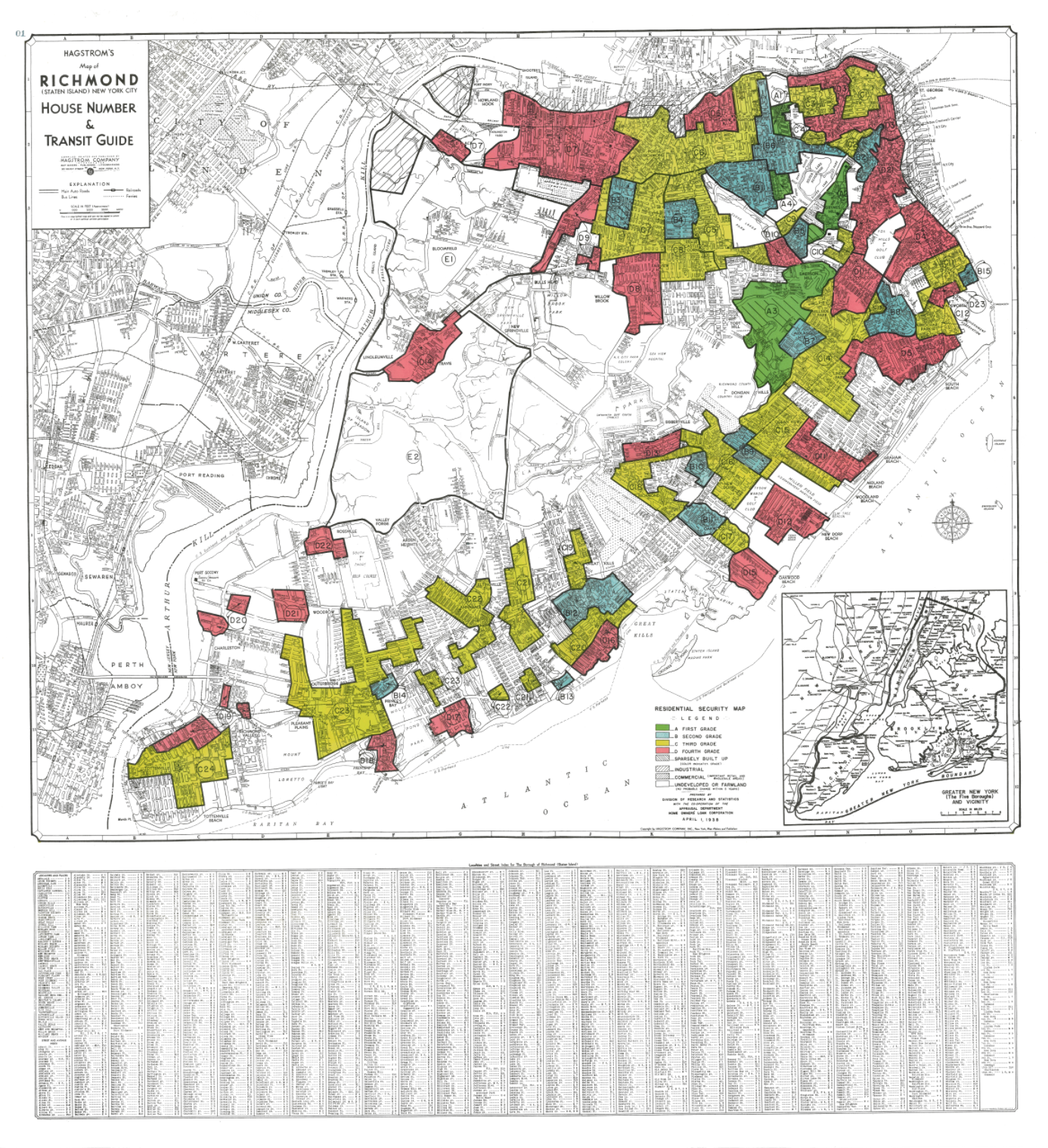

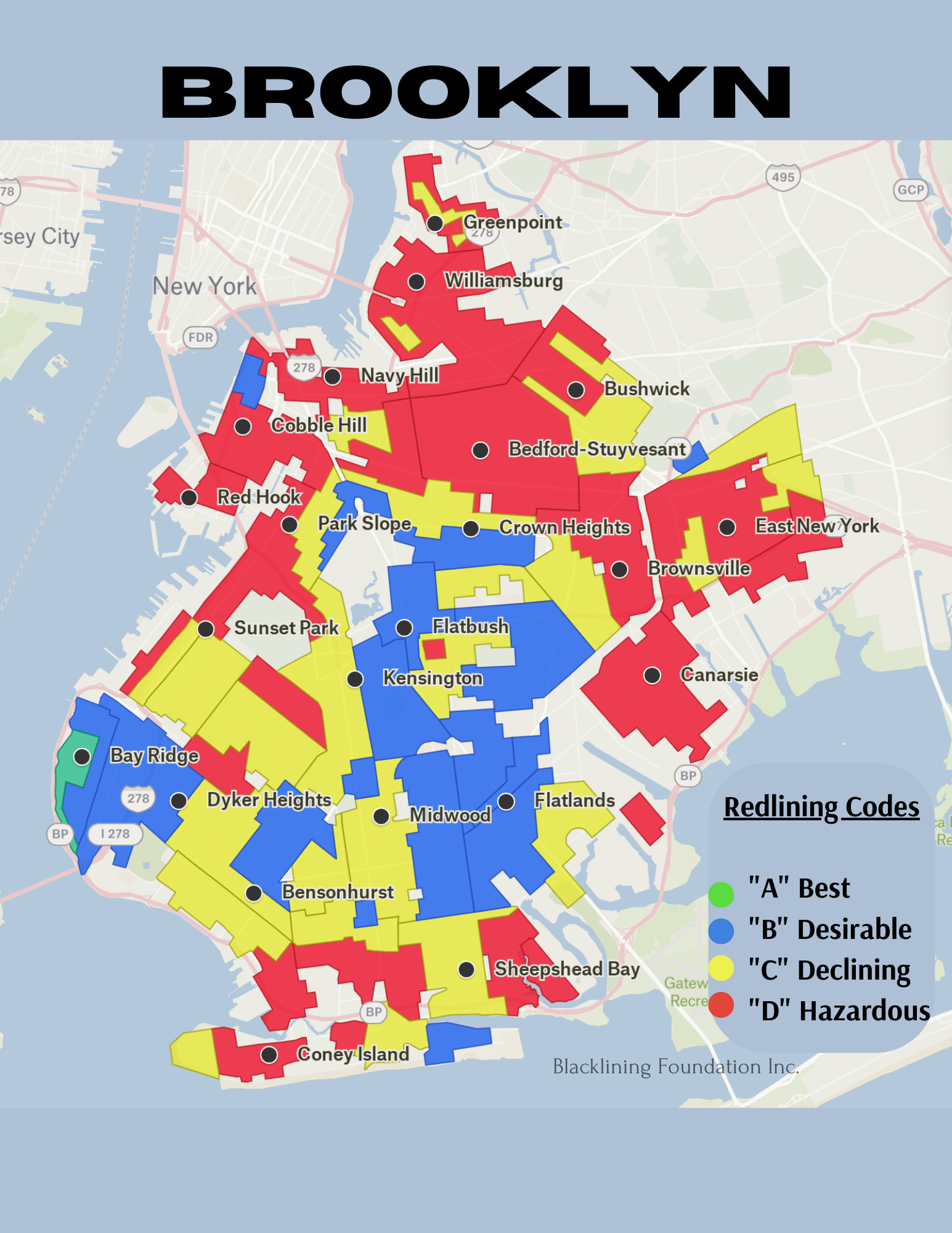

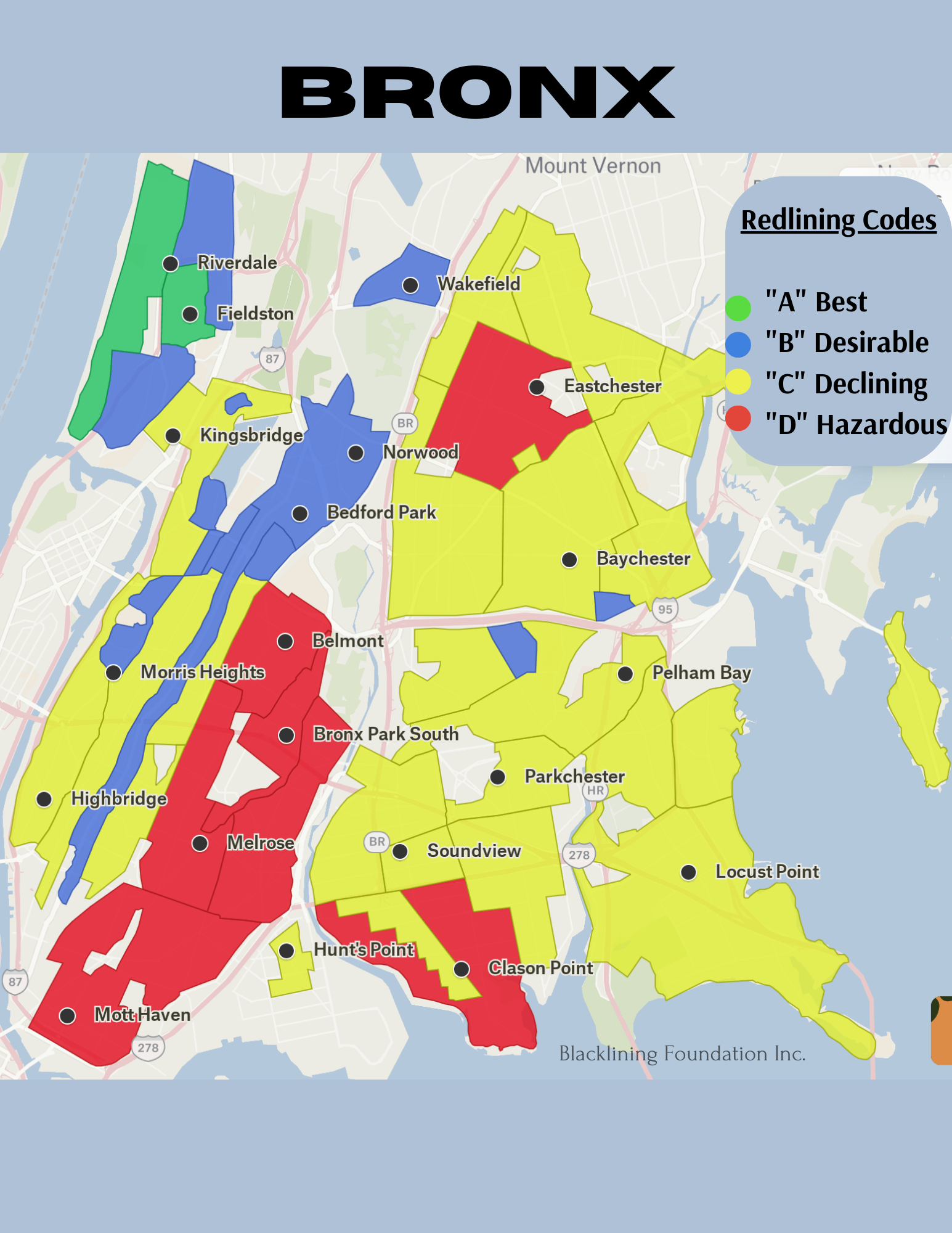

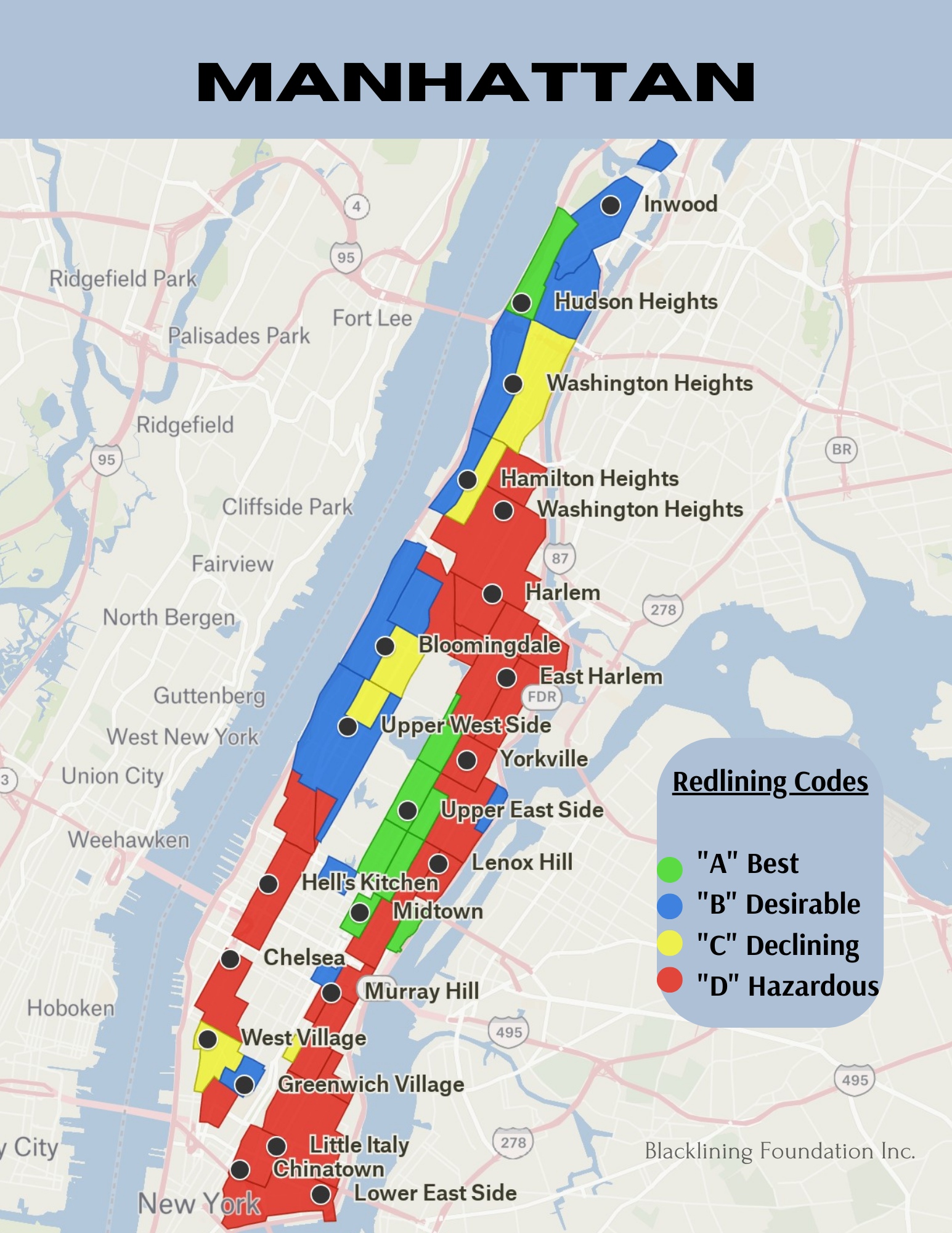

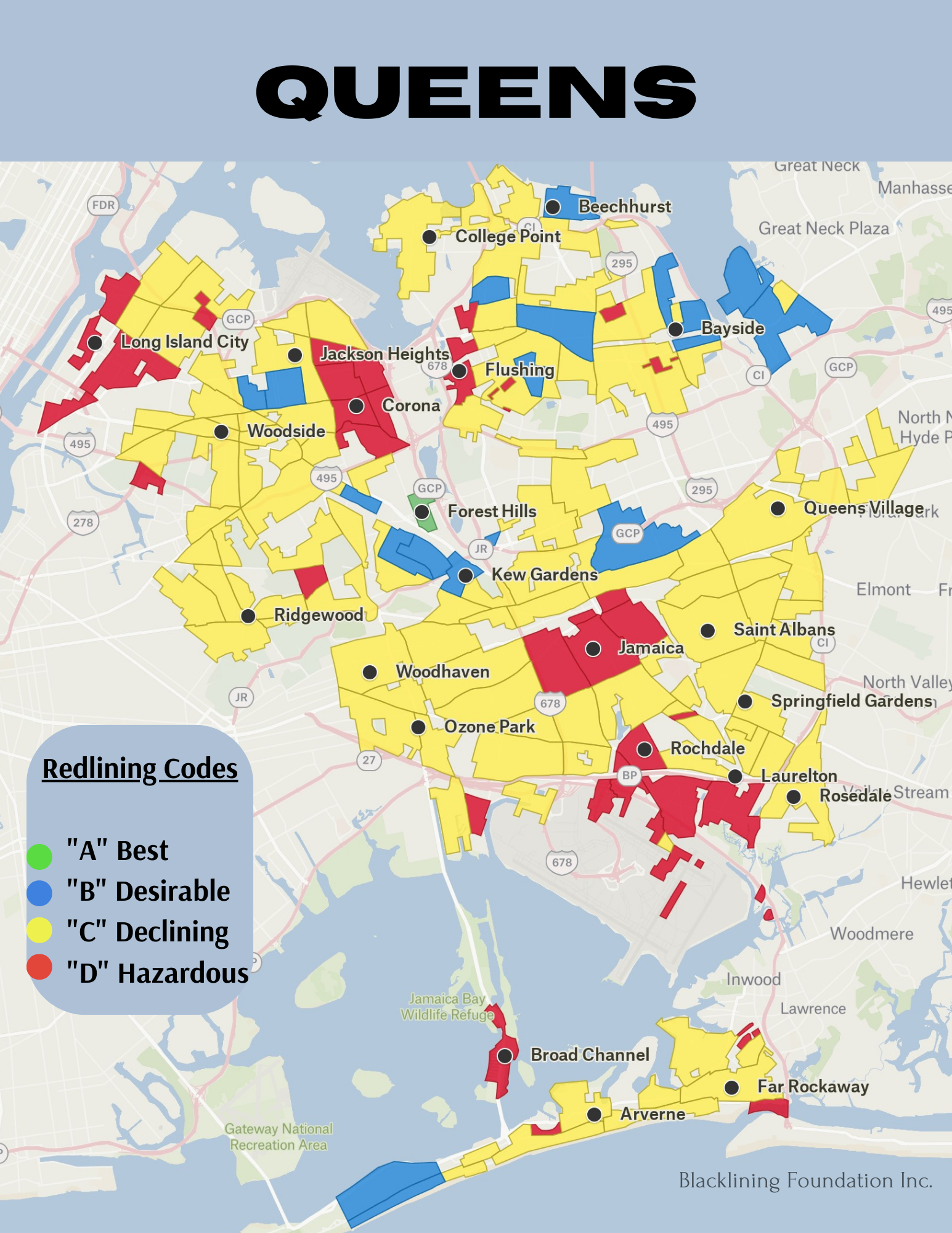

The creation of Home Owners Loan Cooperation (HOLC) was for Reform. HOLC established lending requirement to help homeowners pay their mortgages, prevent homelessness and avert banks from going under. The Residential Security Map created by HOLC used the following color and graded coding system to evaluate neighborhoods.

The Three R’s of Franklin D. Roosevelt, relief, recovery and reform created the Three I’s for Black Americans, Injustice, Inequities and Inequalities. The Three(3) R’s allowed HOLC to create Redlining.

What do the colors mean on the Map

A (Best): Upper & Middle Class ALL white Neighborhoods. HOLC defined Green neighborhoods as posing minimal risk for banks and other mortgage lenders. Green areas were classified as “ethically homogeneous” and had room for further development.

B (Still Desirable): An established neighborhood, generally or completely white United States citizens. HOLC defined Blue neighborhoods as “still desirable” and sound investments for mortgage lenders.

C (Declining): Neighborhoods bordering Black neighborhoods where European immigrants and working-class people lived. HOLC defined these neighborhoods as “declining” because of their proximity to Black areas and the possibility that black people could join the neighborhood

D (Hazardous): Neighborhoods that had predominantly Black residents. Red Neighborhoods were close to Industrial Areas and had older buildings and infrastructure. HOLC defined Red neighborhoods as “infiltrated with an “undesirable population” and “hazardous”.

In 1935 HOLC parent organization, Federal Home Loan Bank Board (FHLBB) adopted the practice of Redlining created by HOLC. The Residential Security Map would not only be used to evaluate lending risk, it would also be used by the Veterans Administration, appraisers, federal agencies, insurance companies, private lenders, developers, and real estate professionals as a way to deny black people the right to purchase homes, acquire mortgages, build generational wealth and establish themselves as functioning Americans

1932

FDR Elected

1933

President Franklin D. Roosevelt introduced the New Deal which was a series of programs, public work projects, financial reforms and regulations and the inception of the 3 Rs Relief, Recovery & Reform enacted to rescue Americans from the Great Depression

1933

Establishment of The Home Owners Loan Corporation (HOLC) established under the direction of President Franklin D. Roosevelt for the purpose to refinance home mortgages currently in default to prevent foreclosure and expand home buying opportunities.

1933

HOLC creates Redlining a housing appraisal system of color coded maps which categorized the riskiness of lending to specific neighborhoods using racial, ethnics and immigrant composition to categorize creditworthiness.

1935

Federal Home Loan Board (FHLBB) establishing Redlining as a practice for lending practices across the United States.

1934-1968

Private lenders, Insurance Companies and Lenders would use Redline maps to decide on the creditworthiness of residents living in Redlined Areas.

1951

HOLC ceased operations in 1951, yet redlining was still legal and used to deny Black people the right to purchase homes.

1968

The Fair Housing Act, which prohibits discrimination on the sale, rental and financing of housing based on race, religion, national origin and sex

Effects of Redlining

Reduced Home Ownership in Redlined Areas

Low Home Value in Redlined Areas

Racial Segregation and Limited Diversity in Redlined Areas

Gentrification

Racial Wealth Gap between black and white people

Supermarket Redlining

Food Desserts, food insecurity, limited access to health food options

High levels of poverty

Insufficient collection of property taxes to maintain suitable public works

Limited open and green space

High level of pollution

Higher levels of debilitating health issues such as diabetes, high blood pressure, and heart diseases.